References: award-winning successes

Here are some selected projects and successful clients, for whom we thank for the trust in us to tell their stories here.

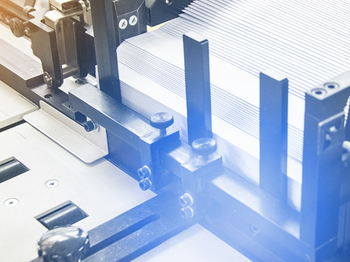

Supplier of forming and bodywork technology

This long-established company based in Baden-Württemberg, Germany, has 2,500 employees worldwide and generates sales of over €500 million with high-quality products and solutions in the automotive environment. The high-performance and innovative product range covers forming and bodywork technology as well as automation systems, machinery and toolmaking. As part of the realignment, sales and production companies were established in China, India and other European countries. Process-oriented business units were introduced and investments were made in digitalization. However, overcapacities in the German main plants, exacerbated by the COVID 19 pandemic occurring simultaneously with temporary declines in the market.

European market leader for envelopes

A renowned envelope manufacturer produces 20 billion paper envelopes of all shapes and functions annually across 18 countries, operating through a complex holding structure comprising over 40 companies. The owner-managed holding structure, with a history dating back to 1807, finds itself in a critical situation in early 2017. The company, with an annual sales volume of over 200 million euros, has invested heavily in acquisitions and resulted in stagnation: internationally targeted growth is failing to materialize, integration of the acquisitions is slow and the markets are becoming more digital - the paper envelope is simply losing importance. Consequently, a persistent loss situation despite internal countermeasures and increasingly tight liquidity threatened the company’s viability, exacerbated by its intricate corporate structure and numerous financing partners, sairing the specter of insolvency. Action must be taken quickly.

Manufacturer and operator of recycling plants

With a turnover of more than € 230 million, the Eggersmann Group is one of the market leaders in the European recycling industry. Its operations encompass machinery and plant engineering, the management of composting facilities, and various ancillary activities. Until 2016, the group experienced dynamic growth, driven in part by numerous acquisitions both domestically and internationally. However, this expansion resulted in a high level of product diversity, spread over more than 30 individual companies and ten production sites with historically grown systems and processes. In 2017, there was a market-related drop in performance of almost 20% and a first-time loss situation. Despite attempts at selective, decentralized optimization, the desired success remained elusive.

Software for Autonomous Driving, Connectivity and Electromobility

CMORE Automotive GmbH is a partner of the automotive industry for future mobility worldwide and offers comprehensive engineering, data and platform solutions for autonomous driving, connectivity and electromobility.

The company's services range from vehicle prototyping and conducting test drives to software development and manual labeling to fully automated data annotation models using AI and programming self-learning algorithms.

System solutions made of sheet metal

The metal processor, which consists of two companies, generates consolidated annual sales of around 50 million euros with 250 employees. While the parent company in Upper Swabia specializes in complex machine cladding or control cabinets, the subsidiary based in the Rhine region is one of the technology leaders in the field of special cabins for maritime and mining applications. Rooted in history, the group of owner-managed companies traces its origins back to 1846.

The subsidiary's high dependence on one main customer has led to an existential earnings crisis. In addition, operational challenges have arisen due to an unprofitable expansion of the product portfolio and the associated complexity.

The parent company is fundamentally efficient, but a temporary drop in demand and a lack of sales efforts are leading to underutilization. In addition, the subsidiary’s predicament is straining management and financial resources. The cross-guarantee system of the two companies, which is being formed during the group's refinancing, makes finding a solution even more difficult.

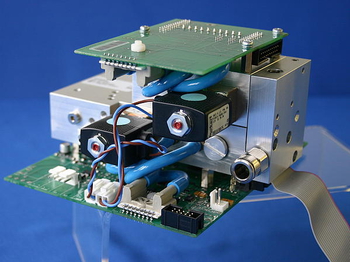

Development service provider in medical technology

Seleon GmbH, founded in 1998 with locations in Heilbronn and Dessau, emerged as a leading product development partners for medical technology companies in Class I and III. The company specializes in the development of complex medical technology systems and supplies the entire range of services from the product idea through approval to series production according to international standards. Central areas of competence are in the respiratory and cardiology segments, with specialization in small series production of highly complex technologies. In addition, Seleon offers consulting services for all development-related regulatory issues, international approvals and company certifications. The company, which works for internationally active, well-known medium-sized companies and corporations, achieved sales of just under 20 million euros in 2018 with 100 employees.

Restructuring of a special car body manufacturer

Hartmann Spezialkarosserien is a supplier of high-quality commercial vehicle conversions for cash-in-transit and motorhomes, among other things. With a turnover of €12 million, the company employed 140 people at its headquarters. Since the peak year, the company had experienced a 40% drop in sales without adjusting costs accordingly. Massive losses and an existential liquidity bottleneck were the result.

The shareholder of the company is a foundation - the injection of own funds was thus limited. bachert&partner was commissioned by the shareholder to compare the options for action with regard to an out-of-court and an insolvency-based solution.

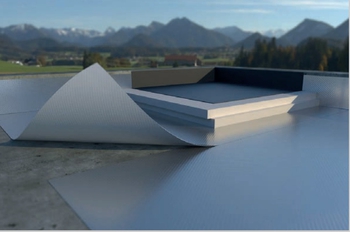

Renowned dealer in the construction industry back on the road to success

The Layer Group is an owner-managed family business that operates on the market as a manufacturer and distributor of (highly) breathable roofing membranes, facade membranes, vapor barriers, insulation materials, and wind- and airtight roofing accessories. As a fully integrated producer and supplier, it oversees the entire value chain from production to international sales via its own distribution channels to B2B customers. The group achieved sales of around € 30 million and employs 140 people at three locations in Germany. However, in 2015, growth is slowed down by the integration of a new production site. This transition resulted in a surge in structural costs while sales volume stagnates.